Property taxes in Santa Fe County are collected by the Santa Fe County Treasurer. Compared to many other places in the nation, Santa Fe County has relatively low property tax rates, making it an attractive place to buy.

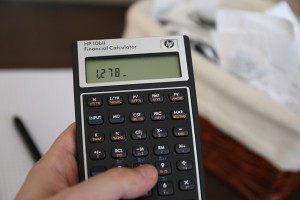

In Santa Fe County, your property will be taxed at 1/3 of its market value, making it relatively easy to calculate your own taxes. A New Mexico constitutional restriction sets the maximum amount your home can be taxed at 33.1% of its market value.

There are also restrictions on how much your property taxes can go up over time.

Once you purchase a property, current law limits the amount that your taxes can increase over the course of a year. This is set at 3% maximum per year at present.

Getting Information

In April of each year, you’ll have a Notice of Value mailed to you. This will contain all the tax information about your property and the current valuation of your property according to the County.

You can correct any information you believe to be erroneous by contacting the Office of the County Assessor within 30 days of the notice being mailed. If you do not get this notice in April, be sure to report it to the Office of the County Assessor. You can protest the valuation of the property, the classification and the allocation. If you’re claiming an exemption and it’s been denied, you can also protest the denial.

You have to file any such protests within 30 days of receiving the Notice of Value.

You can go to the County website to get more information on property taxes.

Resources:

http://www.santafecountynm.gov/